Many of us are asked to generate invoices for our work, but what is needed on an invoice? There are many templates online, but ideally, you are setting up an invoice that is easy for you to complete and easy for the person paying the bill to read.

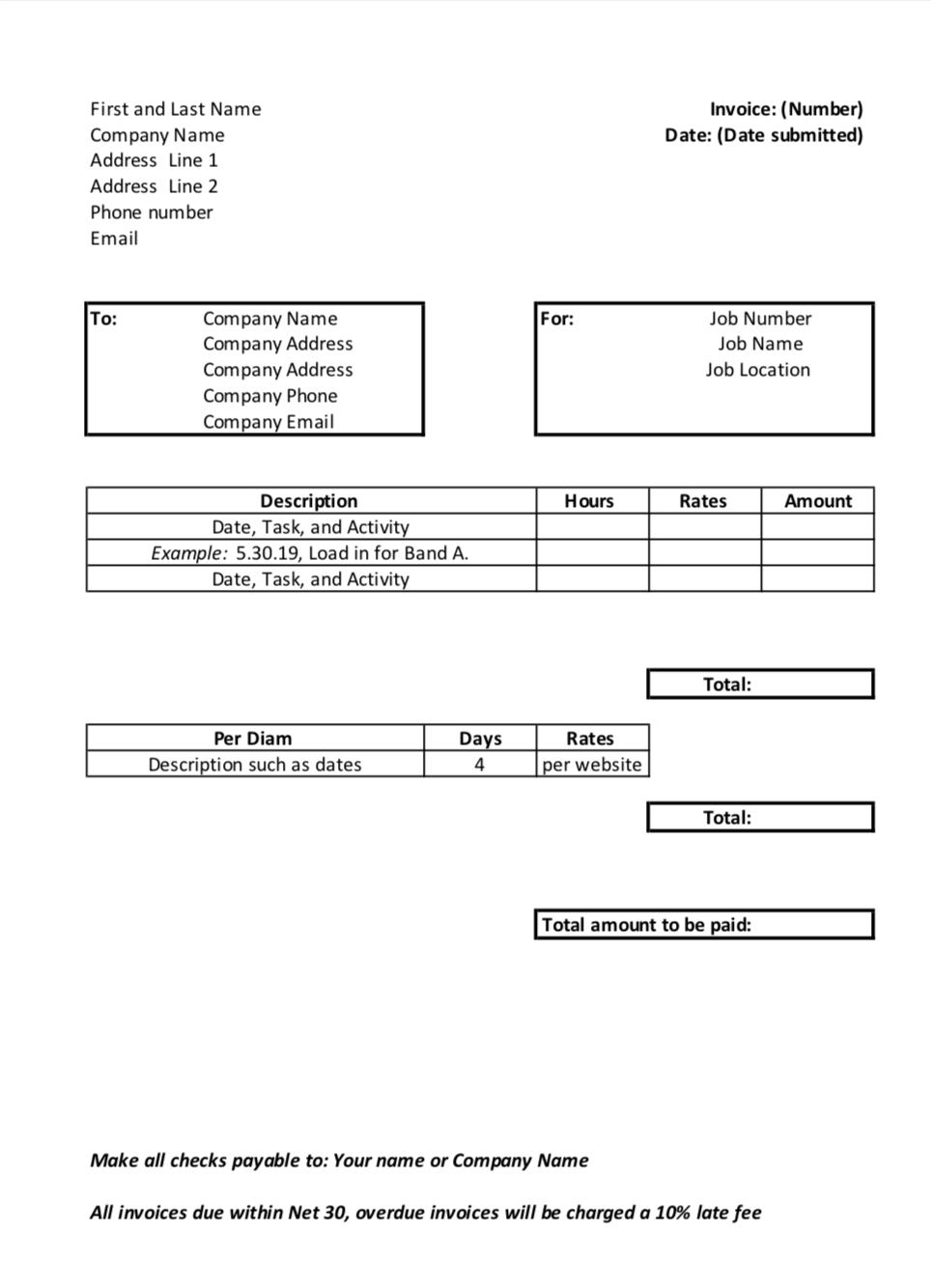

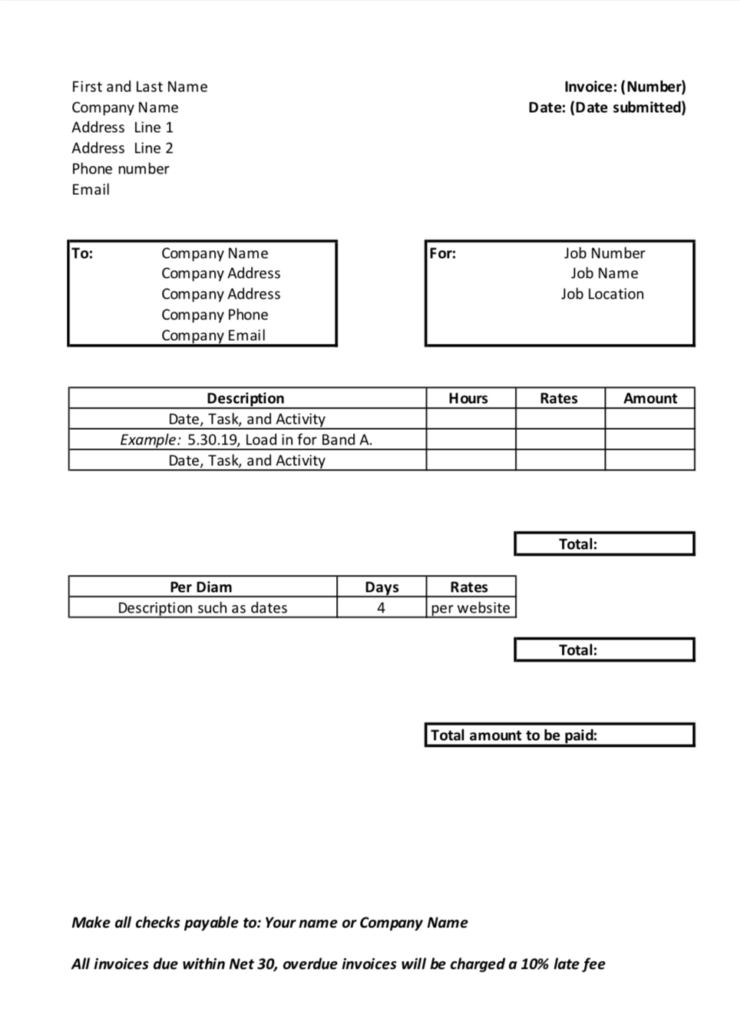

I suggest building your template using something like excel or google sheets, so you don’t need to recreate the important sections of your invoice all the time. Items that won’t change frequently but are required on every invoice include your name, e-mail, mailing address, phone number, and your company name if you have one. All this information should be at the top left of your invoice.

Each invoice should have a different invoice number for tracking, for simplicity, keep this at the top right of the document. Also, include the date of the invoice there as well. This helps the date stand out, so you know when the invoice was created and submitted. In result, you can track when you should be paid as you set your Net terms.

Net terms, usually at the bottom of the invoice, is the timeframe in which you require invoices to be paid. For example, you may note something like “All invoices due within Net 30, overdue invoices will be charged a 10% late fee.” You will want to select a timeframe that is reasonable for an accounting department to fulfill. Most do Net 15 or Net 30. This net timeframe is based on the date you send the bill, which should also match the date at the top of your invoice. In this same area consider adding a note of whom checks should be made out too such as your name or a company name.

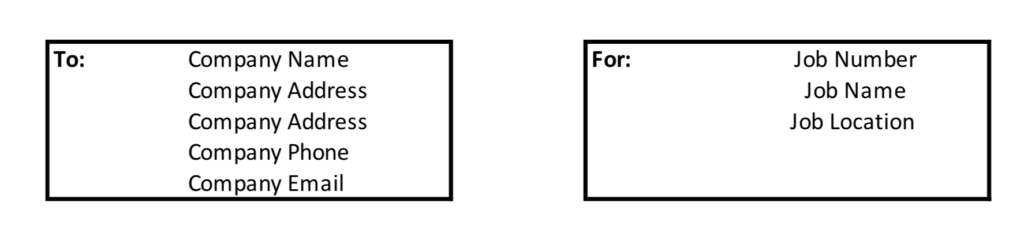

Your invoice also needs information about who you are billing and what you are billing. Make sure to have the company’s full details such as name, address, email, and phone number. Then include references to what you are billing. Here I use the company’s job number, job name, and the job location. This will help you as well as the accounting department sort your paperwork faster for payment.

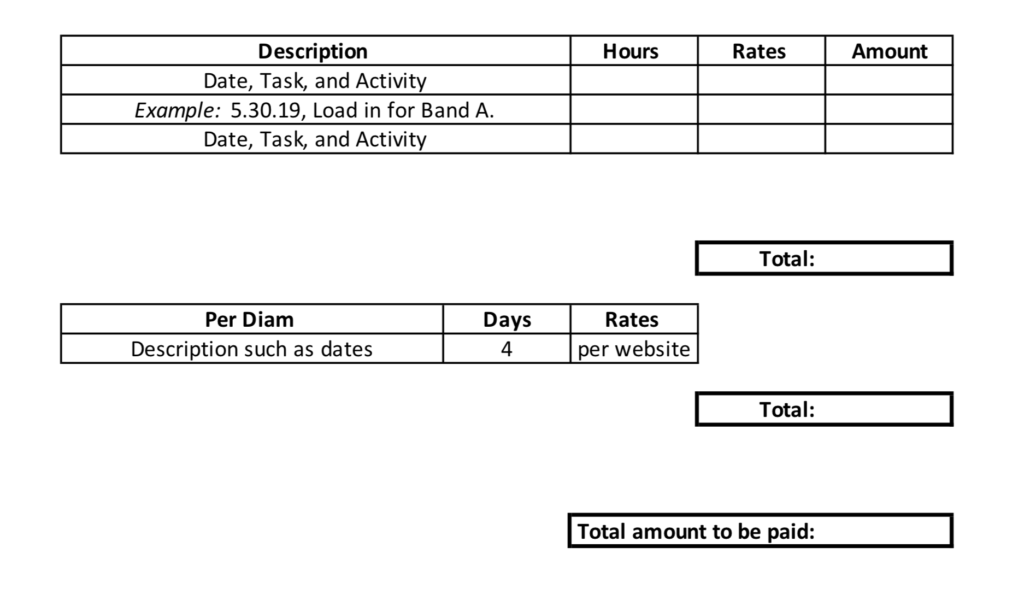

Next is the most vital part of the invoice – the amount you are going to be paid! This is the center of the invoice. Here you are going to provide a description of the work, hours, rates, and totals. Lay this out in an easy to read format and help yourself by inserting formulas to do the math for you. Your description should include the date, task, or position you performed, and activity you did, such as load in, show, or load out.

Here is also where you also would include chargebacks for per diem. I recommend you list this separately, so it doesn’t get lost in your invoice as well as for your records since per diam is tracked/taxed differently depending on your location. Reimbursements could be listed in the section as well, but don’t forget to attach the receipt.

You will want to communicate with each company for all events your expectations for per diem, such as the rate and payment timeline. Some people prefer cash in advance while others invoice after the event. As far as rate, each company seems to treat this differently, but if you are in the states and want to know the going rate, you can refer to the US federal website for this information. https://www.gsa.gov/travel/plan-book/per-diem-rates/per-diem-rates-lookup Keep in mind some companies will follow this recommendation and others will not. Make sure to have this discussion before you commit to working for the company or before each event if needed; work with them to agree on the amount.

Adjust your invoice template as you go. Feel free to use a little color or design, but nothing major as you want to make sure the necessary parts stand out. You will learn what works better for each company and what works better for you. Remember to submit your invoice within a timely manner. I suggest a day or two after the event. This way, you don’t forget the details you need to invoice for, and you can get paid faster! Plus, then it’s on the company’s to do list and not yours!