It can be a pretty boring subject, but if you’re a touring freelancer you need to pay attention! This year the tax deadline has been extended, hurrah. Although it’s likely there won’t be much to report, boo. Either way, we can look ahead to when we will all be earning again.

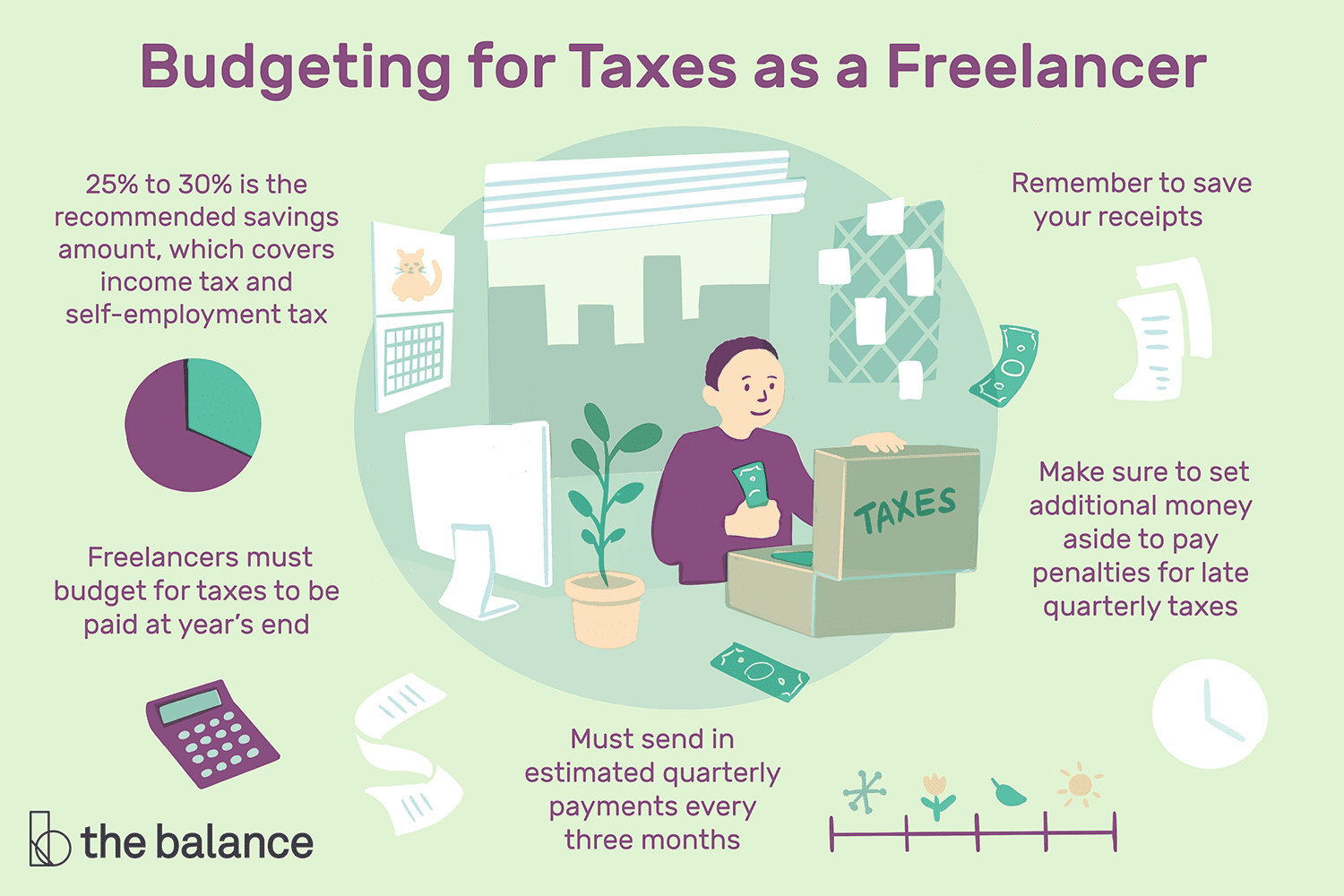

If you are self-employed or work through an LLC you’ll need to keep a portion of your income aside for taxes. If you’re on the payroll, someone else takes care of this for you, which seems like a bummer at the time as you get less money in your bank account, but it’s for your benefit come tax time (can you say refund!?).

A good rule of thumb is to put aside 30-35% of your income immediately before paying anything else. I suggest opening up a savings account and transferring the 30-35% anytime you get paid. Trust me when I say you will thank yourself come tax-filing time. Even if you pay taxes quarterly, you should act as if that 30-35% doesn’t exist in your account. Take it out, remove it, immediately!! Do not fall into the trap of thinking you will have the money when the time comes to pay the tax bill. Most people will have spent it without even realising. It happens so easily.

If you can get disciplined with your finances, you will have a stronger career. You will be able to manage your money and time better because you are on top of your financial game. You won’t have to take a gig you wouldn’t normally take just because you need to pay those taxes. This is the very first step to take to managing your finances well. It doesn’t need to feel intimidating, it’s just common sense and a little restraint and discipline (we all want to buy shiny things when we get paid!)

Of course, I could go down the route of “Pay yourself first” where you contribute to retirement accounts that are tax-deductible and then you account for your taxes after that, but I think that is next level and maybe for another blog altogether!

Once you have yourself covered with taxes, you can start looking to reduce your tax bill with deductions like travel and meals. Your accountant will be able to tell you what is and isn’t deductible, and yes you probably should have an accountant. If it sounds expensive, just know that the cost of the accountant is also deductible and they will probably reduce your tax bill by more than their fee.

So to sum up:

- Save 30-35% of your income immediately into a savings account for your tax bill

- Get an accountant

- Go enjoy the rest of your paycheck!

If you have any questions, I’d be happy to chat over email. Until the next time…

More on Taxes and Finances

Surviving This Tour Life: A Financial Guide