Whether you are a freelance sound engineer, session musician, tour manager, or backline technician, what we all have in common is that we like to be paid for the work we carry out. If you are not on a salary, you will most likely invoice the companies you work for.

It is incredibly important to get your invoice right from the start; it will save you and the company a lot of time if you get it right from the beginning.

You can find loads of templates online, and invoices might vary slightly from country to country. However, the basics are all the same, and there is some crucial information you need to include in your invoice.

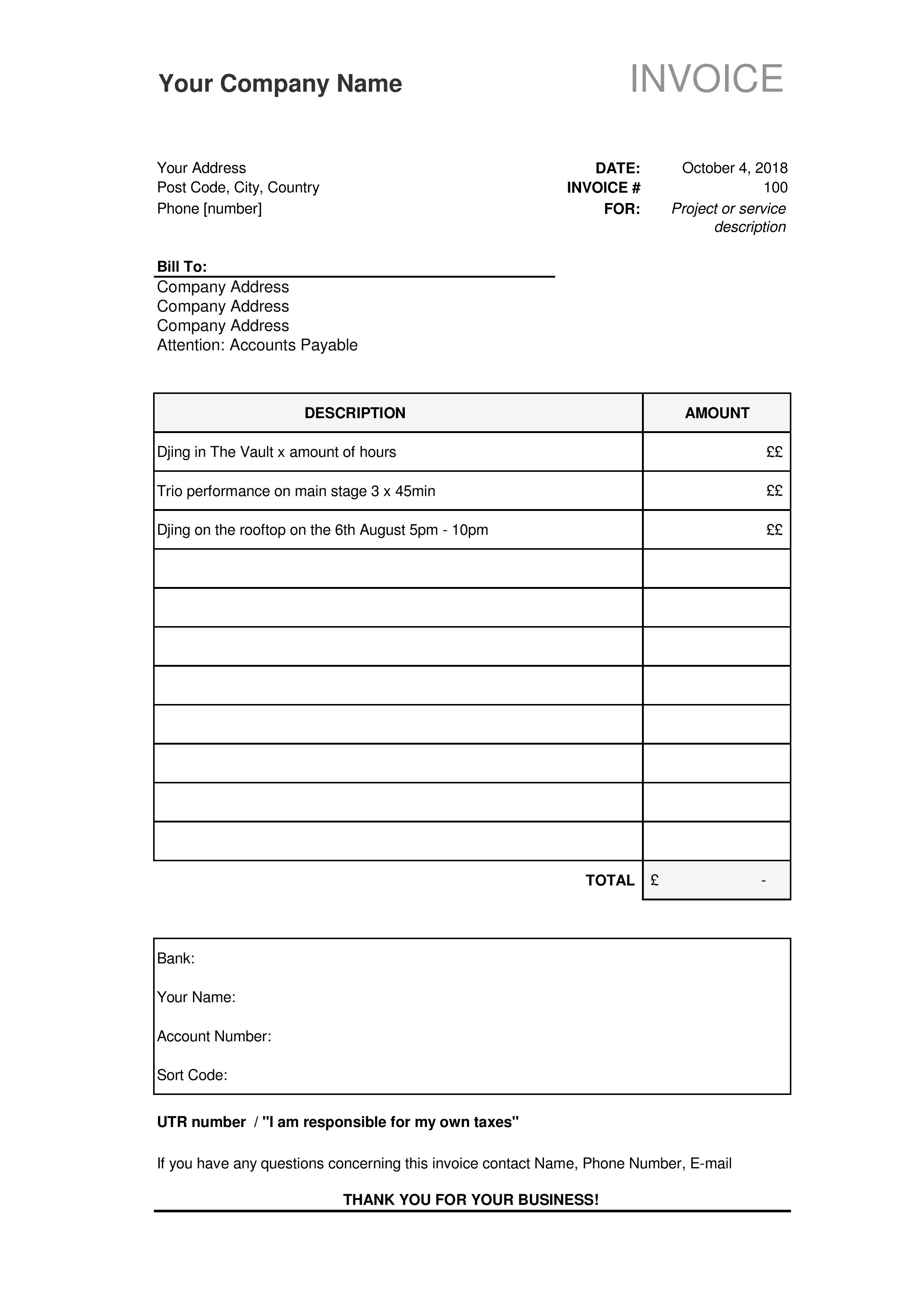

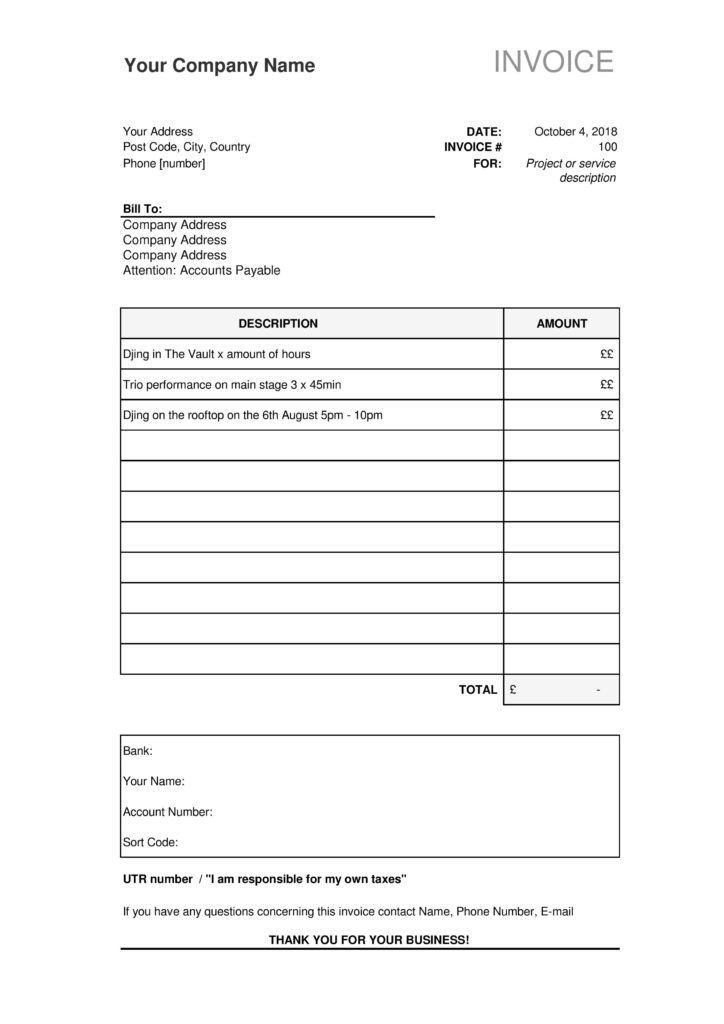

Here is a simple guide on what a basic invoice needs to include:

Your Name / Company Name: This one is quite obvious, it needs to be clear who is invoicing the company.

Your contact information: Your full address, including city and country. You will also need to provide your phone number.

Date: The date you are sending the invoice. This is crucial, this way you can keep track of whether your invoice is overdue or not.

Invoice number: This one is important, especially if you are invoicing a company regularly, this way the accounts team can keep track of which invoices have been processed and which are due to be processed. It also helps you to keep track of your own invoices and how many you have sent.

For: Project or service description.

Bill to: The Company / Person you are invoicing and their address. Add ‘Attention’ depending on what department or person you are invoicing.

Description of the work carried out: The more accurate description, the better, where you have been working, what department, what date and for how long.

The amount: The amount you charge for your work.

Value added tax (VAT): If you are a VAT registered business, you need to add VAT, which is usually between 15%-20% of the amount charged.

Total amount: Sum up the amount (and VAT if you have a VAT registered business) to a total amount.

Bank Details: Now do not forget to add your correct bank details. This might seem obvious, but I’ve seen plenty of invoices which did not include their bank details, or their details were incorrect.

Add your bank, full name, sort code, and account number.

Format: PDF is the way to go. That way your invoice can not be altered with. Name your PDF after your invoice number. Also, include your name and surname, i.e., Invoice#1001FirstnameSurname.

Email: Make sure you are emailing the right department/person. If you send your invoice to the wrong department/person, it will take longer to process your invoice. Worst case, it will get lost between people, which will delay the process even further.

When emailing your invoice make sure you write something along the lines of:

“Dear Sir / Madame / Name of the person,

Please find attached my invoice for my (description such as DJ/session musician/sound technician) services at your company. If you have any questions concerning this invoice, please do not hesitate to get in touch.

Kind regards,

First name Surname “

It does not have to be long, but it needs to be polite, professional and give them some information about the invoice they have just received.

It can take up to 30 days for invoices to be processed and paid which is standard. In the UK, usually, VAT invoices must be issued within 30 days of the date of supply or the date of payment (if you’re paid in advance).

Overdue fees: In the UK we have the ‘Late Payment of Commercial Debts (Interest) Act 1998′, which means that if a payment is overdue, you can claim a late payment fee. The statutory right to claim interest and compensation is not compulsory, and it is for the supplier to decide whether or not to make use of their rights.

Make sure to look up your rights and acts in your country and do not hesitate to get in touch with a solicitor to help you if you need further assistance with any claims or questions regarding any late payments.