Laura Moeller • Live Sound • Theatre • Education

Laura Moeller (She/Her)

Live Sound • Theatre • Education

Laura Moeller is an Audio Educator and Partnership Coordinator at Tech 25, where she combines her passions for live sound, theatre, and teaching. With over a decade of experience in audio, Laura has built a career that bridges both technical expertise and community-driven education, working full-time while also taking on freelance projects.

Laura’s love of audio began in 6th grade, when a teacher introduced her class to GarageBand. That spark grew into a career path after discovering the Commercial Music Technology program at Penn West California (formerly California University of PA). She went on to earn her B.S. in Commercial Music Technology, majoring in guitar and minoring in voice.

While at university, Laura was deeply involved in music and performance. She was a four-year member of the university choir and a two-year member of the auditioned vocal ensemble, Cal Singers. She also sang in the a cappella group Isolated Incident, competing in the ICCAs, and played guitar in the folk band Buffalo Run.

Her passion for music and sound traces back even further: Laura learned to play her mother’s electric organ before she could read, picked up the guitar at age 10, and found encouragement from community members who supported her early performances. Throughout high school, she explored choir, theatre, and even violin, though she found her home in fretted instruments and vocal performance.

Today, Laura continues to build on that foundation, working at the intersection of live production, theatre, and audio education. Her work reflects not only her technical skills but also her commitment to mentoring and creating pathways for the next generation of audio professionals.

Career Start

How did you get your start?

College helped pave the way for opportunities, but my start came by a chance meeting. I was working a summer job in between semesters, and struck up a conversation with a customer. Came to find out that he owned his own small live sound company. I ended up interning and eventually working for his company for several years. I still freelance with them on occasion too. I also started working on the overhire list for IATSE Local 3 around the same time, and got to experience huge, professional level productions.

How did your early internships or jobs help build a foundation for where you are now?

When I was in school, I really thought that I’d end up recording/mixing/mastering. I wanted to be more on the post-production side of things. The thought of doing live sound scared me, to be honest. But meeting Mike and getting an internship doing live sound made me fall in love with it. Experiencing the excitement and sheer technical complexity around stadium shows with IATSE motivated me to learn more. It changed my path toward live event production instead.

What did you learn interning or on your early gigs?

I learned a lot about the technical side of live sound and production. I became more familiar with terminology, safety, and the general process of a show from prep to load out. However, I think the most important lessons I learned were soft skills. How to network, how to negotiate, and how to communicate effectively. Unfortunately, I also had to learn a bit about when to move on from situations and people that weren’t there to help me succeed.

Did you have a mentor or someone that really helped you?

Quite a few! Mike Johns of Mastertrack Productions gave me my internship and helped me get on tour with my first artist. Caitlin Jones (Freelance A1) walked me through her workflow, and inspired me to be a better engineer. Tom Fury (house sound engineer for Heinz Hall), allowed me to shadow him, and recommended me for my first job with a production company. Toby Ekmann (Former Project Manager, Tech Extraordinaire), taught me so much in just a few years of working with him. And finally, Carolyn Slothour (Freelance Audio Engineer/Educator). We met while we were in college, and formed a friendship that continues to benefit our professional development. We were co-chapterheads for SoundGirls Pittsburgh for a while. We’ve worked together for a long time, and I count her as one of my greatest allies in the industry.

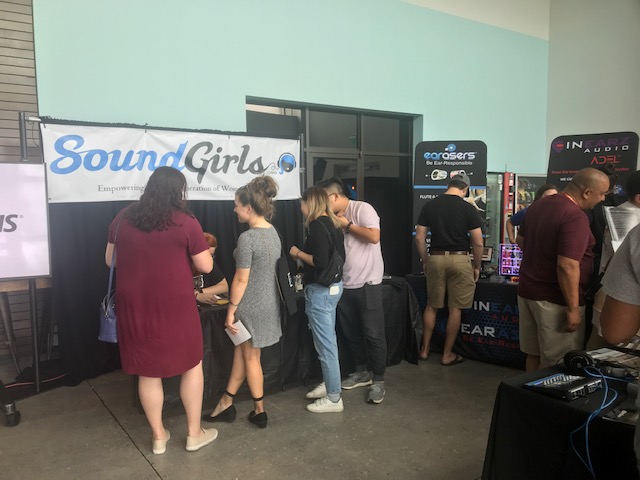

By far, however, I think SoundGirls was the best mentorship I had in my early career.. I found out about the organization when I was working as a stagehand on Warped Tour with a few women on the sound crew. The rest is history. I got involved, started the chapter here in Pittsburgh, met so many inspirational people, and found a huge community that was so willing to help and support me in my early career.

Career Now

What is a typical day like?

That’s a tough question. I don’t think I really have a typical day. Some days, I’m up at the local arena doing a load in for a major tour at 6 AM. Other days, I’m helping out with a high school musical. In a few weeks I might be at a music festival in the middle of nowhere. But this week, I’m teaching classes on audio at Tech 25, planning and coordinating partnerships, and trying to catch up on my backlog of emails.

How do you stay organized and focused?

My life is Google Calendar. Between coordinating events and classes at Tech 25, and the myriad of other work that I’m juggling, I try to keep everything on my radar. I make lots of to-do lists, and log all of my freelancing through QuickBooks.

What do you enjoy the most about your job?

I love the challenge and variety of each day. I’m a problem solver, so I really enjoy troubleshooting and fixing issues with audio gear, computers, networks, etc. I also love seeing the impact I make as an educator. It’s really rewarding being able to watch someone learn and progress through their career; taking on new challenges and opportunities, and being excited to share that with us.

What do you like least?

Sometimes, the hours are unpredictable and long. Often, I’m staying on a show site until every last piece is packed up on the truck and ready to roll. Getting home at 3 AM is pretty common for me.

What is your favorite day off activity?

I love to go tent camping with my wife, and my dog. We usually find a nice trail to hike, or we just chill at our campsite all day while cooking some delicious food over the fire.

What are your long term goals?

I’d love to own and operate my own venue someday.

What if any obstacles or barriers have you faced?

Unfortunately, in my early career I encountered pretty blatant homophobia and misogyny. Also occasional gatekeepers who would laugh and try to embarrass you when you did something wrong, instead of correcting or helping you.

How have you dealt with them?

I realized that I needed to start valuing myself more. A job/experience wasn’t worth staying in an abusive environment. There are far more good people out there that want to watch you succeed. People who value your safety and worth; folks willing to mentor you.

Advice you have for other women who wish to enter the field?

Never stop learning. Audio is a constantly evolving landscape. It’s changing just as quickly as the other technologies around us. There are so many fantastic resources out there to learn and grow.

Also, when you’re first starting out, value yourself and treat yourself with kindness. You deserve a living wage, sleep, and time to relax. You don’t have to know everything. Truth is, no one does.

Must have skills?

Networking is your best friend. Make sure you follow up and keep in contact with friends, colleagues, and your communities. All of the work I have today, I got through a professional contact or mutual friend. Also, take time to train and care for your hearing. Invest in a good set of earplugs, and make sure you always practice your critical listening.